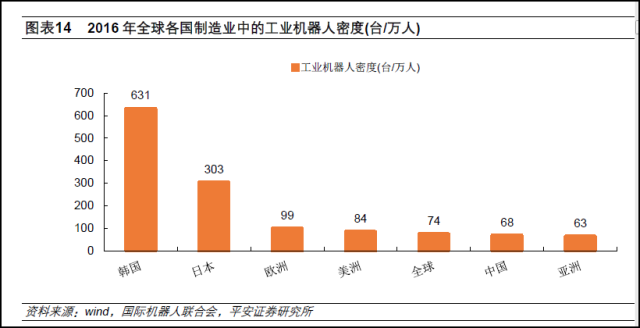

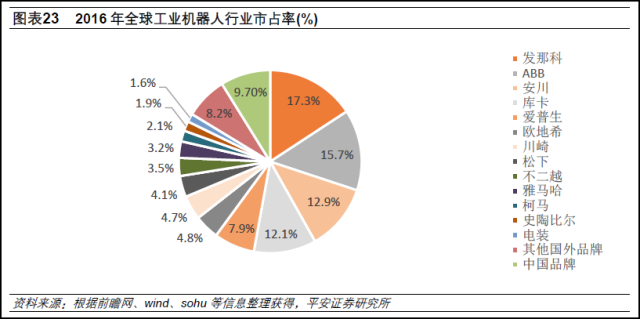

In the past two years, with the rising labor costs in China, industrial robots have become more and more important to the manufacturing industry. Public statistics show that since 2013, China has been the chief consumer of industrial robots for five consecutive years. Although consumption ranks first, what is China's robot manufacturing industry? Recently, Ping An Securities issued an industry report titled "Industrial Chain of Industrial Robots Booms, Domestic Brands Rise in Big Wave". The report shows that China's robot manufacturing industry has made great progress, but in the "three cores" In terms of spare parts, the international giants still have high technical barriers. The robot output has increased year after year, and the market is broad According to the report, the sales volume of industrial robots in China was approximately 136,000 units in 2017, an increase of 92% year-on-year in 2016. Compared with South Korea, Japan, and other countries, the density of industrial robots in China's manufacturing industry is relatively low. It is expected that the average growth rate of industrial robot sales in China will exceed 20% in the next 5-8 years. In terms of density, the density of industrial robots in China's manufacturing industry is only 68 units per 10,000 people, which is close to the average level of 74 units per 10,000 people in the world, but it is still lower than the 99 units per 10,000 people in Europe, far lower than Japan ( 303/ten thousand people) and South Korea (631/ten thousand people). In 2016, China's manufacturing sector accounted for 28.8% of GDP, which is close to the figure of South Korea (29.3%). Therefore, the report believes that China should use South Korea as a comparison to estimate the demand for future industrial robots in China. The blockade of the "four big families" of robots and the breakthrough of domestic brands According to the report, in 2016, Fanuc, abb, Yaskawa, and Kuka accounted for 58% of the world's four major families of industrial robots. Other internationally renowned brands also have global share of more than 4% respectively. In contrast, domestic robots have a low share in the global market, totaling 9.7%. The same is true in China. In the same year, the “Four Big Families†accounted for 57.4% of the domestic market share. Domestic brands accounted for only about 32.8%, but compared with 25% in 2015, domestic production has made considerable progress. According to the goal of the “Robotic Industry Development Plan (2016-2020)†formulated by the state, in the period 2017-2020, the annual output of our own brand industrial robots will reach 100,000 units, and more than 50,000 robots with six axes or more. If this goal is successfully completed, it means that the combined growth rate of self-owned brand industrial robots in China will reach 37% between 2017 and 2020. In addition, in addition to the disadvantage of market share, the report stated that foreign robotics companies also set up large-scale factories in China, reducing their own manufacturing costs and competing directly with Chinese manufacturers. In the short term, domestic companies do not have an advantage. But on the other hand, under the full "encirclement and suppression" of foreign investment, how has domestically produced robots broken through? According to the report, overseas robot companies such as the “Four Big Family†first set up factories in China, and also trained Chinese talents, which is conducive to the proliferation of professionals and technology. And as a veteran manufacturer, domestic manufacturers can also achieve breakthroughs by learning the mature experience of overseas companies. Secondly, although the robot industry in China started relatively late, it has developed very rapidly recently. In 2016, the number of domestic robot-related patents reached 18,201, an increase of 57% year-on-year. In 2010, this number was still less than 2,000, showing that China’s robots have been in recent years. Key technologies in the field are accelerating breakthroughs. One of the missing core components: servo system Although China is in a breakthrough in the field of robotics, on the other hand, in terms of the three core components of robots, foreign technical barriers are still very strong. The first is the servo system. The servo system is the main power source for industrial robots. It is mainly composed of servo motor, servo driver and encoder. The meaning of servo is "Following", which refers to following the command signal to make following control of position, speed or torque. According to the report, at present, the servo system for industrial robots in China is mainly monopolized by foreign brands, with Japanese accounting for about 50%, European and American brands for 30%, and Taiwanese brands and mainland companies only 10%. Japanese companies include Yaskawa, Mitsubishi, Sanyo, Omron, Panasonic and other companies, mainly small and medium-sized power products; Europe and the United States include Siemens, Bosch Rexroth, Schneider and other companies, have a dominant position in the large-scale servo; domestic mainly including the Inovance, Taiwan Tatsu, Eston and other companies, mainly for small and medium-sized servo. On the whole, there is still a gap between China's servo motors and the Japanese and European and American countries. The main manifestations are: lack of high-power products, insufficient miniaturization, unstable signal connectors, and lack of high-precision encoders. These are also the domestic servo systems that will attack the future. The main direction. The second part of the core components: reducer The second serious deficiency is the reducer, which has a monopoly of 85% in the global reducer market. The report shows that the manufacture of precision speed reducers has large investment, high technical difficulty and high barriers. Because of this, the global market for industrial robot reducers is highly concentrated, with Nabtesco in Japan monopolizing the field of RV reducers and Harmonaco in Japan monopolizing the field of harmonic reducers, both of which account for the world's total. About 75% of the market, another Japanese manufacturer Sumitomo occupied 10%. Due to its extremely high technical barriers, the industrial robot manufacturing process has very weak bargaining power for the reducer link. Moreover, breakthroughs in barriers to reducer speeds have not been accomplished overnight. The world's major reducer manufacturers started R&D and production very early. In contrast, the earlier Qinchuan machine tools in China had to wait until 1997 to begin R&D only. Wait until the day. The consequences of the lack of speed reducer are quite serious. According to the report of the China High-tech Industry Review on March 30th, the speed reducer is taken as an example. According to Zhang Jie, CEO of domestic Lai Fu Harmonics, Japan, which has a global monopoly in terms of harmonic reducer, is introduced. The price that Hamernaco sells to the "four big families" of robots is about 2,000 yuan, and the price that is sold to Chinese manufacturers is as high as 6,000 yuan or more. "China, as the world's largest robot market, has been monopolized by foreign countries before." Zhang Jie analyzed, "If we have not developed domestic core components, the Chinese robotics industry will not have any opportunities." The missing third part of the core components: controller As the "brain" of industrial robots, China's development in this area is also insufficient. According to the report of Ping An Securities, the control system is a concentrated expression of the design concept of an industrial robot manufacturer. Mature robot manufacturers generally develop controllers and servo systems on their own, thereby ensuring the stability and technical system of the robot. Therefore, the market share of global control systems is close to that of industrial robots. According to the report, with the increasing degree of intelligence in the future, the differentiation among ontologies manufacturers will become more and more significant. This difference is mainly reflected in the differences in control systems. With the gradual accumulation of domestic manufacturers' technology, the gap between current control systems and foreign products is gradually narrowing. Domestic well-known industrial robot manufacturers have independently developed their own control systems, including Xinsong Robot, Eston, Huazhong CNC, Xinshida, Guangzhou CNC, and Huichuan Technologies, and a number of professional control systems have also been born. Service providers such as Googol Technology, Inventronics, and Knoop. Subwoofer Speaker,Professional Speaker,Voice Coil Subwoofer,21Inch Subwoofer Guangzhou BMY Electronic Limited company , https://www.bmy-speakers.com